Motor Vehicles - 20 to 25 4. The tax legislation only provides a 2 rate of tax depreciation per year for immovable property except for land.

Depreciation Methods 4 Types Of Depreciation You Must Know

The table below shows the estimated depreciation rate for cars in Malaysia.

. Again depreciation 10 per annum will be calculated on the acquisition value for the entire useful life of the asset from the date of acquisition. General rates of allowance for Industrial building whether constructed or purchased. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses.

Shows like outlander and the last kingdom. New cars typically depreciate between 15 to 25 percent annually until the fifth year. First Initial Depreciation would be.

2018 only provide depreciation estimates of total property value in Tokyo since. This Standard does not apply to. The Institute is established under the Accountants Act 1967.

No longer able to support its exchange rate the government was forced to float the Thai baht which was pegged to the US. Therefore the annual depreciation is 25000 50000 x 15 150000 x 110. This Standard supersedes MASB Approved Accounting Standard IAS 16 Property Plant and Equipment.

This Standard should be applied in accounting for property plant and equipment except when another MASB Standard requires or permits a different accounting treatment. Giggleswick school uniform shop. MASB - Malaysian Accounting Standards Board.

Max Period yrs 1. Ii the balance of the cost allocated cost 150000 with a useful life of 10 years. Renovation depreciation rate in malaysia 2020.

Prince nightclub minneapolis. After a year your car would have a depreciation rate of up to 20 percent from its original price. 10 on 10000 1000 and this will be same for next 8 years.

Dayton leroy rogers family. This Standard should be applied in accounting for depreciation. Annual Depreciation for 2010 would be.

Coppell city council members. Rate of depreciation applicable on the asset is 14. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in.

I the lining element allocated cost 50000 with a useful life of five years and. After the fifth year the car loses about 60 percent of its original value. - Initial allowance IA.

All fields are mandatory. Depreciation Method is SLM. 20 on 10000 2000.

Enter a rate of 20 the annual depreciation for the first three years is. Annual allowance at the prescribed rates calculated on cost. Renovation depreciation rate in malaysia 2020renovation depreciation rate in malaysia 2020.

The asset has two depreciable components. Awwa c600 testing requirements pdf. My Blog renovation depreciation rate in malaysia 2020.

10 - Annual allowance AA. B forests and similar regenerative natural resources. A property plant and equipment see MASB 15 Property Plant and Equipment.

Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. This Standard applies to all depreciable assets except. C expenditures on the exploration for and extraction of minerals.

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Of Building Definition Examples How To Calculate

Depreciation How It Works Examples

Temporal Method Meaning Example How It Works

Depreciation Of Building Definition Examples How To Calculate

Different Methods Of Depreciation Calculation Sap Blogs

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Reducing Balance Method Depreciaiton Youtube

Depreciation Methods 4 Types Of Depreciation You Must Know

Different Methods Of Depreciation Calculation Sap Blogs

Accumulated Depreciation Definition Formula Calculation

Different Methods Of Depreciation Calculation Sap Blogs

Casio Scientific Calculator Fx82ms Original Cbpbook Pakistan39 S Largest Online Book Store Scientific Calculator Label Printer Calculator

Casio Sl 300vc Standard Function Calculator Pink 5 89 Liked On Polyvore Featuring Home Home Decor Office Basic Calculator Calculator Basic Calculators

Rental Rate Blue Book Cost Recovery Equipmentwatch

New 2022 Irs Standard Mileage Rates

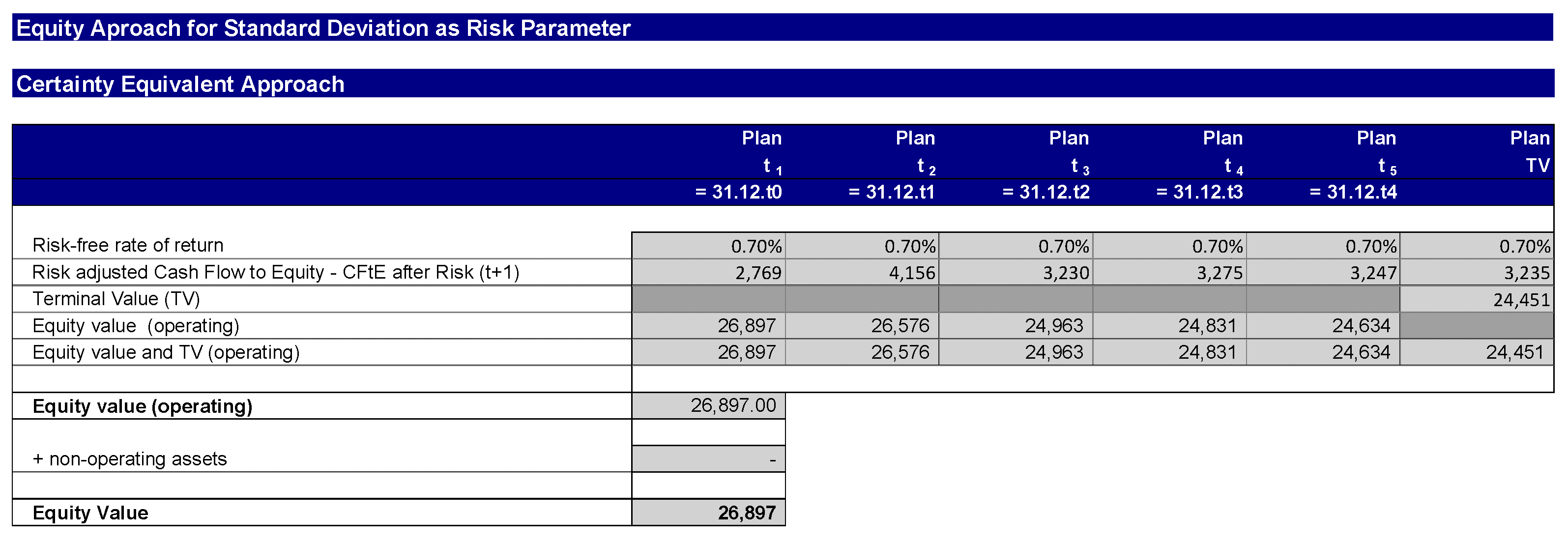

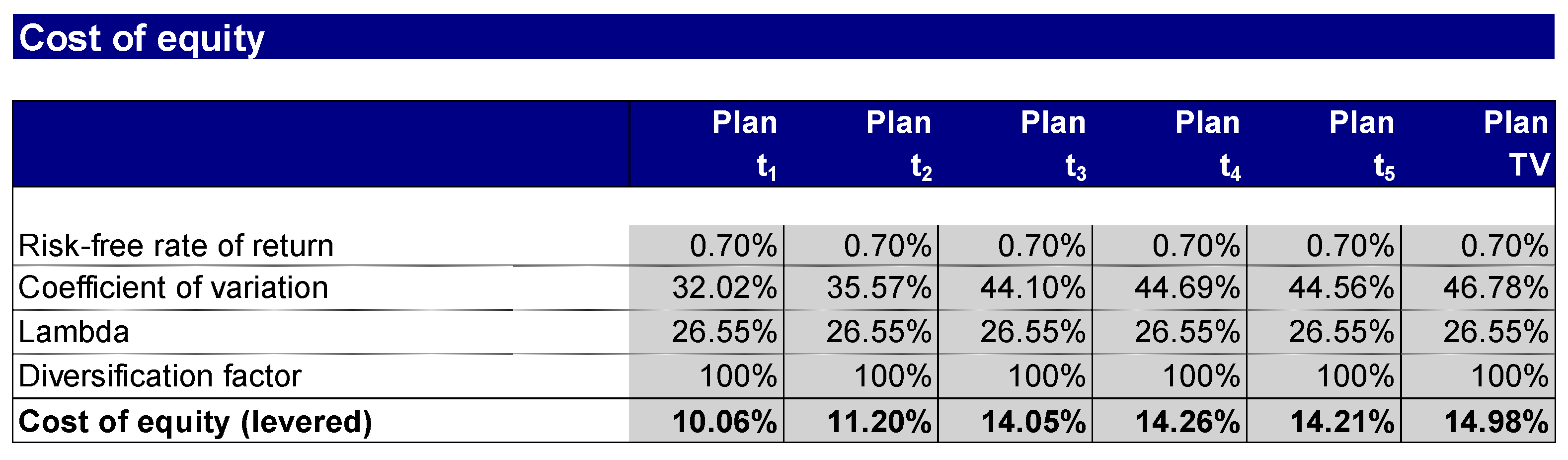

Jrfm Free Full Text Simulation Based Business Valuation Methodical Implementation In The Valuation Practice Html

Jrfm Free Full Text Simulation Based Business Valuation Methodical Implementation In The Valuation Practice Html